Thanks to digital banking solutions, it is so practical to open a dedicated IBAN account for business in terms of both time and costs now.

If you desire to have such an account for your business project, you can contact a reputable online banking platform that serves in this field alike.

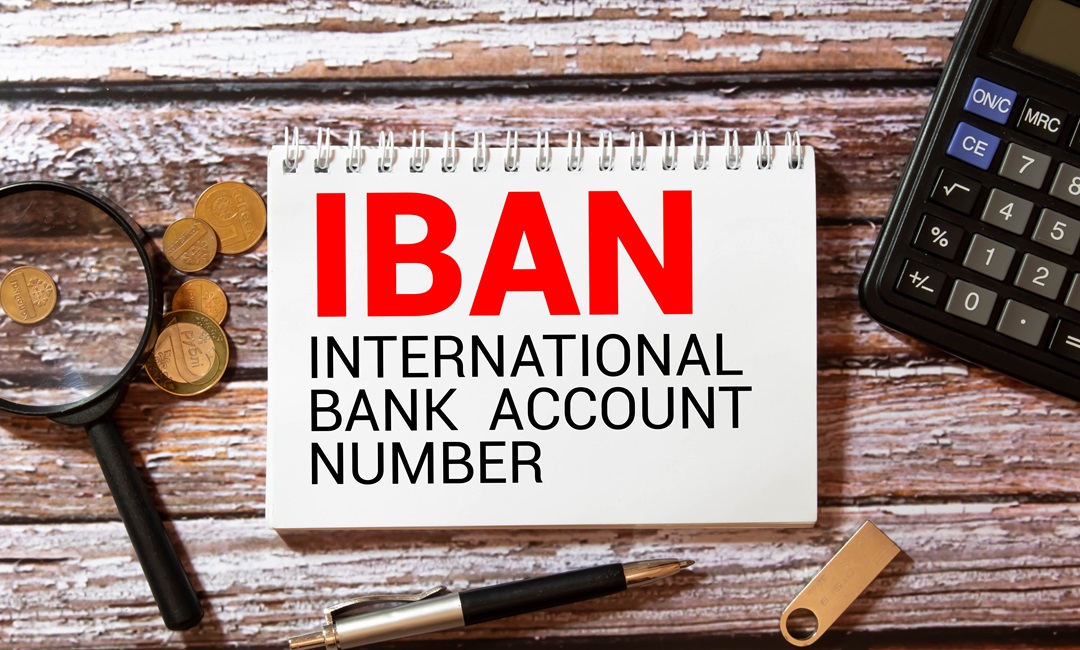

When you create a bank account in any bank or financial institution except crypto wallets, you have to have an IBAN code.

These codes enable users to make transfers with each other. They are unique codes for every user. This provides a standardized ecosystem even for international transfers.

You can detect an individual or business’s detailed information about the bank accounts by examining just IBAN codes. You can also have more than one IBAN code associated with your bank accounts. By using these codes, you can receive the funds from users who are in the same network.

However, the financial platform that offers opening a dedicated IBAN for your business, you should choose one reputable financial institution.

Since your international transactions need a developed banking service, you should work with a reliable platform.

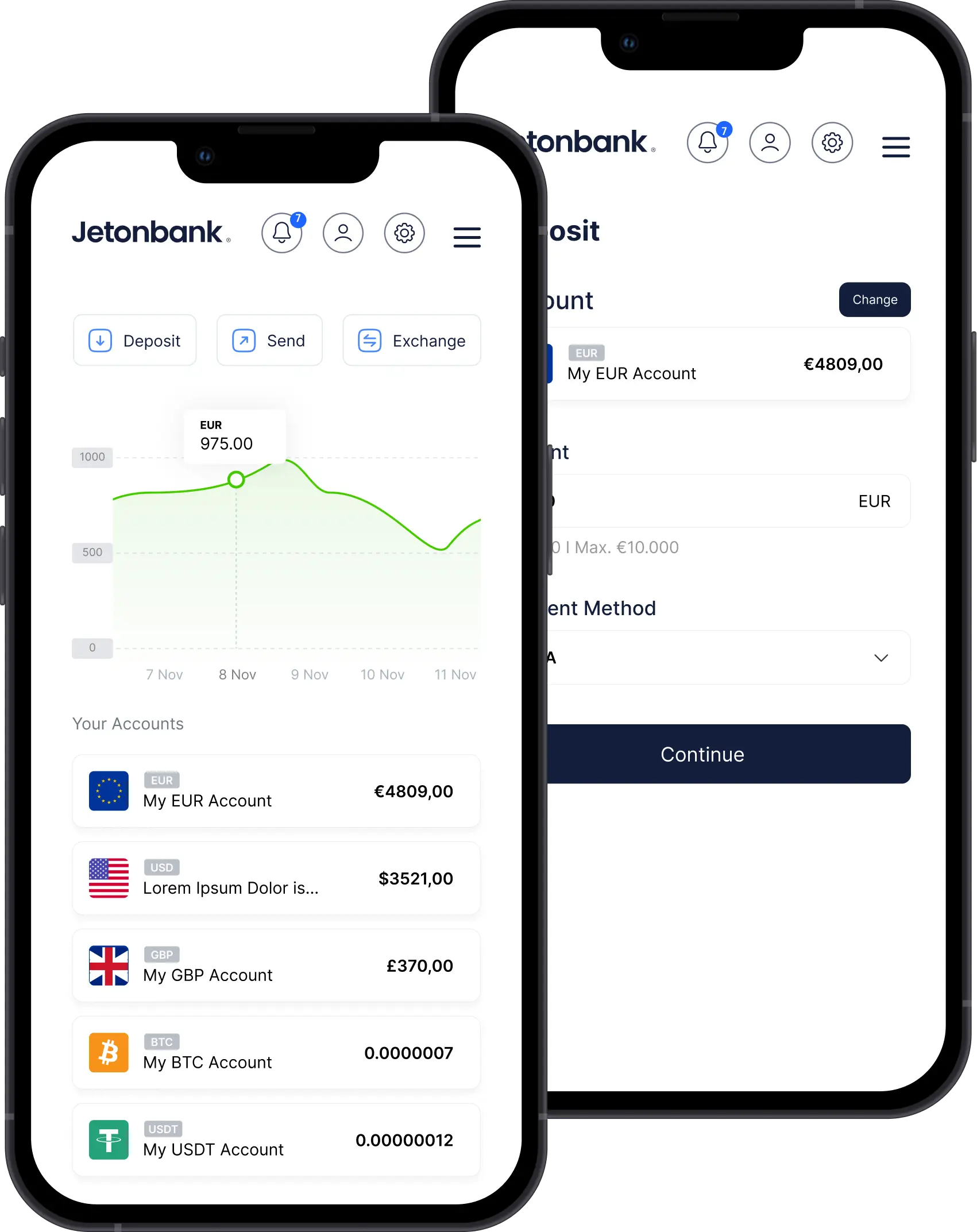

At Jetonbank, we offer solutions for getting IBANs and managing international transactions by using these codes. If your business needs these, you can reach Jetonbank.

What is a Dedicated IBAN?

It can simply be defined as follows: Dedicated IBAN refers to a specialized and unique number used for cross-border payments and the exchange of funds.

IBAN stands for International Bank Account Number. With dedicated IBANs, businesses can manage international financial transactions from payment to receiving funds.

Since all dedicated IBANs are unique numbers assigned to a specific individual or business, all transactions can be done correctly.

Businesses have dedicated IBANs similar to individuals. When other businesses desire to make transfers with another business, they must use dedicated IBANs.

A dedicated IBAN account, or in its longer form dedicated international bank account number, can be utilized for various purposes. It is appropriate for both individual and business usage.

While daily financial needs can be met for individual usage, transactions can be more complex for business ones. Businesses with a dedicated IBAN account can receive many financial products and services through this account, from receiving payments to managing expense records and other global transaction needs.

How Do I Open Dedicated IBAN Account for Business?

You can complete the entire process of opening a dedicated IBAN account for your business online and remotely now.

To open an IBAN account for Business is possible with the help of a reputable financial institution such as Jetonbank.

If you desire to open a dedicated IBAN for business transactions or payments, you should reach a bank or platform services for not only local projects but also international transactions which businesses need.

The application process generally takes a very short time. In this step, you have to submit some documentation related to your business.

Once the bank accounts are created for your business, which can be also called corporate bank accounts, your IBAN code is ready to use immediately.

As Jetonbank, we offer fast and secure solutions to make your business expand globally and take advantage of dedicated IBANs.

How Do I Open a SEPA Bank Account?

Fortunately, thanks to online banking solutions it is so practical to open a SEPA bank account for your business projects.

Businesses must have a SEPA bank account for various transactions. Basically, sending and receiving funds is possible by using IBANs. While international payments require dedicated IBANs, they do not have any chance of missing this.

On the other hand, cross-border trade also requires a dedicated IBAN for each business in the market. In some cases, businesses can manage these transactions just by using SWIFT and IBAN codes.

Foreign exchange transactions are also done by using these codes.

If a business desires to reach global customers including receiving payments or paying suppliers, they have to contact a bank that services for creating dedicated IBANs for business.

What are the Requirements to Open a Dedicated IBAN Account?

We should remind you that there are some requirements for opening a dedicated IBAN account for businesses.

Although it may vary depending on which country you are in and which financial platform you are utilizing, these are generally most common requirements for getting a dedicated IBAN account:

- Submission of ID or passport for Identity verification. Some banks may also request address information.

- Official documents proving sources of income.

- Declaration of the purpose for which the dedicated IBAN account will be utilized

- Compliance with legal regulations, security checks

- Some financial institutions may require a minimum deposit for your dedicated IBAN account to be activated

These requirements are essential for the security of both you and other users in the same ecosystem with you.

After these documents are submitted completely and accurately, your dedicated IBAN account will be opened in a very short time. Then, you can benefit from the privileges of having a dedicated IBAN account for your business.

Thanks to today’s online banking solutions, all of these requirements can be submitted online. This provides a great efficiency for businesses in terms of both time and costs.

How to Get Dedicated IBAN Account Online?

While opening a dedicated IBAN account for a business can be a challenging and long process with traditional banking methods, it can be completed in minutes thanks to today’s digital banking solutions.

The entire process, from the application process to making transactions through this account, can be managed online.

To get a dedicated IBAN account online, you must first determine a financial institution. This financial institution must provide an online dedicated IBAN account service.

Since different banks offer different services and fees, you should determine the one that best suits your business perspective. Then you must apply online to this digital banking platform.

You must submit the documents requested from you during the online application process. You must complete the submission process by transferring the physical documents you have to the computer environment by scanning them.

The platform you applied to open a dedicated IBAN account for your business will review these documents and then approve if you don't have any issue.